Mitigation is a term that means diminishing or moderating the force or intensity of something. When applied to the power of a natural phenomenon, say, like the high winds that can arise during a tropical storm or hurricane, mitigation means lessening their destructive character by the implementation of certain building techniques in order to prevent or reduce the damage they can cause to a home or other structure.

In coastal areas, and especially in states such as Florida, tropical storms and hurricanes are more common than they are elsewhere in the country. In fact, hurricane season in the Sunshine State lasts for six months each year, from June 1 to November 30. And although we have been fortunate to have avoided major catastrophic damage over the last few hurricane seasons, it is only a matter of time before the next devastating hurricane sweeps across the Florida peninsula.

Florida homeowners would be hard-pressed to forget the damage inflicted by Hurricanes Charley and Ivan in 2004, and Katrina and Rita one year later. Because of the widespread destruction caused by these violent storms, many insurance companies went bankrupt over mounting claim and reparation costs, subsequently leaving many homeowners high and not-so dry, in their wake.

In order to protect both property owners and insurance companies alike, and to some extent, government agencies that must often step in to provide financial relief to hurricane victims, in 2006, Florida became the first state in the nation to mandate some form of insurance cost discounts based upon certain wind-mitigating characteristics of a home or commercial structure that would help limit the damage caused by high winds and their associated water intrusion. Florida statute 627.711 requires insurance companies to notify homeowners of premium discounts for hurricane loss mitigation and establishes a uniform mitigation verification inspection form.

However, in order to qualify for this discount, properties must undergo a certified wind mitigation inspection performed by a qualified inspector, usually a board-certified contractor, architect or engineer. Once the inspector submits his report to the property owner’s insurance agency, outlining the home or business’s ability to withstand storm damage, an appropriate discount can be applied to the owner’s insurance premium. In Florida, the average discount of 30 percent of the wind portion of the insurance premium (which can be between 15 and 70 percent of the total premium), can save a typical homeowner several hundred dollars a year – not to mention the much greater potential savings in repairs and rebuilding costs should a major storm actually hit.

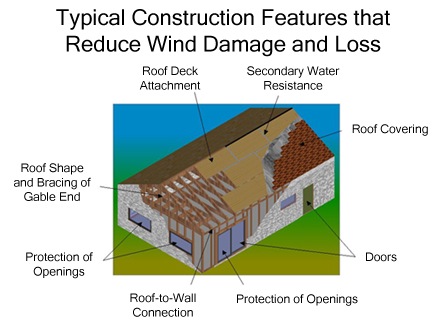

In Florida, a wind mitigation inspector will look at several key categories of safety features that help protect a home from severe wind and water damage, including:

- Roof Covering – The most common roof covering materials in Florida are composition shingles and tiles. A key factor in roof covering performance is the method of attachment of the roof covering material to the roof deck. Nails, not staples, should be used to fasten these materials. Asphalt shingles should be able to withstand winds of over 130 miles per hour. Clay and concrete tiles should be able to ensure uplift resistance.

- Roof Decks – Roof decks, generally made of plywood, should be installed with large nails and close spacing with a maximum of six inches on-center. Warped, damaged or deteriorating roof deck boards need to be replaced and nailed down with a ringed shank to provide a more secure grip.

- Water Barriers– A sealed roof deck can prevent significant water intrusion if roof shingles are blown away in a storm. Vents and soffits must be properly fitted and installed. Roof deck seams should be covered with a self-adhering membrane tape followed by a synthetic underlayment or foam seal, which is sprayed onto the underside of the decking.

- Wall Construction – Steel reinforced concrete block homes will stand up to high winds better than homes with plywood-only framing and plastic siding. The higher the percentage of strong construction materials used for framing and reinforcement, the higher the discount.

- Roof to Wall Anchoring – Wall-to-roof connections that establish a continuous load path allows a home to resist high-wind forces as one unit. Metal connectors, such as hurricane clips or straps that hold the roof structure to the walls add strength, as do wall-to-foundation reinforcements.

- Roof Shape – Gables that are taller than four feet should be reinforced and braced. These gable end-walls, if not properly built or braced, have been known to fail outward due to the negative suctions on the wall. Additionally, tests show that hip roofs receive up to 40 percent less pressure from wind than gable roofs. Chimneys over five feet above the roof, or on the side of the home, should be anchored.

- Glazed Openings – Glass doors and windows should be replaced with impact-resistant glass, or covered by steel or aluminum shutters. Windows should be structurally attached to the building in order to prevent them from popping out of their frames. Sliding glass doors are especially vulnerable to flying debris due to their large expanse and should be protected.

- Doorways – Main doors should be replaced with hurricane rated doors that have at least three mounting brackets and secured with long screws. Garage doors commonly fail during windstorms due to inadequate door-track strength and mounting systems, as well as flimsy metal panels. Existing garage doors can be braced, if replacement is not an option.

Remember, even though wind mitigation inspections are optional and not required by mortgage lenders or insurance companies, they are the only inspections that are likely to result in some level of discount on a homeowner’s insurance policy. The more wind resistive features a property has, the higher the total discount will be.

A wind mitigation inspection usually takes less than an hour, is relatively inexpensive when measured against the potential savings on insurance premiums, and is available for single family homes, multi-family buildings, condominiums and townhouses.